Thinking of moving home?

There could be a number of reasons why you might consider moving home, whether it’s your first step on the property ladder, or moving in with a partner, through to seeking more space for a growing family or downsizing, now that the kids have places of their own. Whatever the reason behind the move, each one is a significant step in life, and needs to be undertaken with care and guidance along the way.

In this guide, we’ll help take you through the key steps and decisions that need to be made as you find a new home. Steps include finding the right property for you, sourcing the funding for your dream home, selling your existing home and practical tips for the moving day itself.

Financing your dream home

Most of us will be looking to finance a new home with a mortgage. If you’ve already got a place, then chances are, you need to look firstly at what kind of mortgage deal you already have to see how much it would cost you to move house.

Many mortgages have an early repayment charge, which you’d have to pay if you move to a new one before the term ends on your existing one. You can get around this by porting your existing mortgage to a new property to save money and retain the same deal.

It’s always advisable to review your mortgage with a professional mortgage adviser. We will help you understand the choices to be made, talk through your circumstances and help to establish how much you could borrow.

One of the main benefits to be had by using us, is that we can obtain mortgage deals from a wide range of lenders across the market and with deals that would be suitably beneficial to your individual need and circumstances.

We’ll go through your financial circumstances, your monthly income and outgoings, and help to advise and recommend a mortgage that’s suitable for you. We’ll explain in detail of what potential fees and charges that may be involved, and afterwards work with you to get a Decision-in-Principle (DIP) to show how much you’re able to borrow, before you place an offer on a property.

Protecting your home

If you’ve just found your dream home and paid a lot of money to get there, you may be surprised how easy it could be to lose it all. As mortgage advisers, it’s our duty of care to ensure you have taken reasonable steps to protect your home against the worst.

This can range from losing your job, to becoming seriously ill, or even sudden death of you or a partner. It’s not something you want to think about, but unfortunately is surprisingly common, and can turn your life upside down very quickly. According to research by Legal & General, if we lost our income, most of us are just 24 days from the breadline..1

1 Source: Legal & General (2021) Deadline to Breadline Available at: https://www.legalandgeneral.com/adviser/protection/news-insight/deadline-to-breadline/ [Accessed 14th April 2021]

There’s a whole range of protection available to help to protect you, and as mortgage advisers, it’s our role to help make you aware of the risks, and potentially help you to mitigate these risks.

It is easy to assume that insurance policies are just another expense on top of taking out a mortgage. However, look closer and there are some great reasons to consider taking out some, to provide additional peace of mind. After all, legally we have to insure our homes and cars, many of us understand the cost of veterinary bills so insure our pets, but rarely do we think of ourselves as worth insuring – yet we are the people that earn the money to live in the home, drive the car and enjoy time with our pets. What happens to the things we insure if we can’t afford to pay the premiums on the house, drive the children to school or walk the dog?

Should you or your family become seriously ill, there will likely be a huge impact on your daily life, especially as any extended period off work places an additional financial burden to meet mortgage payments, possibly adding to the increasing stress at an already difficult time.

To help mitigate the financial risk, provide breathing space to get better and potentially life-saving money for treatments, Critical Illness Cover insurance works by paying out a cash sum if you are diagnosed with or undergo a medical procedure for one of a number of predefined conditions such as cancer, stroke or a heart attack. This money could then be used to help with childcare costs, household bills or maintaining a standard of living if you’re forced to take time off work to recover from the illness.

When things do go wrong, insurance can go a long way to providing the financial support and emotional wellbeing to you or your family at time when it is needed most. Find out about what types of insurance are most suitable to you by talking to us today, we’ll be more than happy to give you a tailored recommendation.

How does the property look?

Outside

Inside

Ultimately, you are looking to see how closely the property meets the needs outlined in your wish list, alongside consideration of how long you intend to live there, and how the property can meet your needs in the future. Once you’ve found your house, and you have a Decision in Principle (DIP), you would generally be ready to go ahead and make an offer.

Putting in an offer

It’s an exciting moment when making an offer on a property, however it’s also one of the biggest purchases you’ll ever make, so it needs to be carried out with some caution.

Firstly, try to avoid getting carried away haggling on a price, and set yourself a maximum budget to avoid exceeding. Consider any additional money you can afford to realistically spend on the property, such as any renovation or repair work needed. Some faults and repairs can be used as a bargaining tool to lower the offer, but also bear in mind that major repairs can affect the valuation of a property.

Study what similar properties have sold for in the local area to guide you. Websites such as Zoopla contain sale details online to back up the valuations you may have from lenders. If you do see a major variation between a lender valuation, the vendor’s asking price, and the amount you have offered, speak to us to find out how we can help you with the funding required to purchase the property.

In instances where the property you are seeking is sought after by several potential purchasers, you can make yourself the more attractive buyer by having a mortgage ready and Decision in Principle in place and ready to go. Once your offer has been accepted, it is still subject to change as your survey results could reveal something that puts you back into the negotiation stage.

Selling your home

Once you’ve decided to move house, generally speaking, you have two options:

Option 1 – Sell your existing house first, then buy the next property

Option 2 – Buy your new house and then sell your existing property

The benefits of the first option mean that you’re in a much stronger position when it comes to making offers, however the downside is that you are likely now in a property chain, which can become complicated, being reliant on a number of other parties and external factors to keep the chain moving.

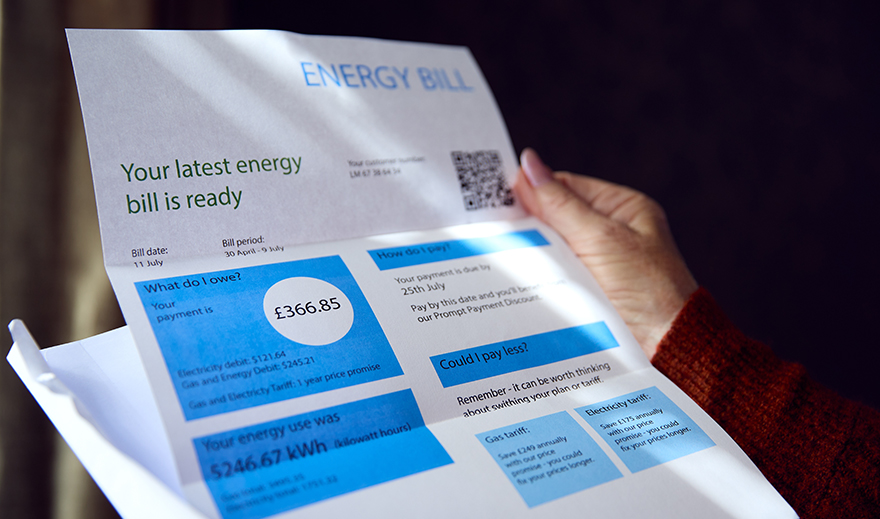

If you decide to go for Option 2, buying your new property first ahead of selling your existing property (i.e. without a chain), then this provides more stability and confidence that you will secure your new property without a sale falling through. However, the downside to this is the cost of owning two properties at once, and the resulting bills arising, including tax and utility costs while you await a buyer for your property. You won’t be able to use your existing mortgage on the new property, so may need to take out a second mortgage for the new home.

Tips to help you in selling your property and purchasing a new one:

Some elements may be out of your immediate control, such as being reliant on other people signing and returning paperwork. In general, you can still help move things along by keeping in touch with your solicitor and estate agent on a regular basis, and never be reluctant to ask where your application is in the process.

Top tips for selling your house

There are some top tips you can follow to try and make your house as attractive as possible for when it comes to selling. Small changes can make a big difference, so think carefully about the below and what you can do to make your property easier, and faster to sell.

Accepting offers on your property

Once you start receiving offers from prospective buyers of your property, it’s important to choose your buyer wisely. Try and look beyond simply the largest offer, consider also which position they are in – are they a first-time-buyer, do they have a Decision in Principle (DIP) or are they caught in the middle of a complex chain? Ask yourself what is most important to you, are you seeking a quick sale or would you prefer to hold out for the right price and buyer?

Surveys and solicitors

A property is likely to be the largest financial commitment you will ever make, so it is critical to understand what you’re buying before you sign on the dotted line. Major structural issues aren’t always easy to spot unless you are a trained professional, so it makes sense having a property surveyed before you commit to purchasing it.

House survey prices can tend to vary depending upon firm used, and the value & type of property, however it is worth completing, not only for peace of mind, but any serious issues found can be either rectified before sale or used as a bargaining tool to save money on your purchase.

What types of house surveys are available?

Solicitors, what do they do?

Once your offer has been accepted, a solicitor will take care of the legalities. This includes drafting contracts, carrying out searches, to overseeing the contract signatures, through to the exchange and completion. Please ensure to seek independent legal advice, as we do not provide this service.

Here’s a little more detail about the stages involved –

Exchanging contracts and completion date

Both buyer and seller must sign identical contracts, which become legally binding once formally exchanged by solicitors. Once the exchange has taken place, this is the right time for buildings insurance to be arranged, which can commence after completion has been reached. If you’re selling a property, be careful to keep your current house insured until the completion date, to be fully protected.

On completion day, your lender will release the funds to your solicitor, who will then transfer the money to your seller’s solicitor. Once this has been completed, you can finally collect the keys to your new home.

Preparing for the move

Once your offer has been accepted and the solicitors are beginning their checks, it’s a great time to start preparing for the move. Planning and organisation are the secrets to a relaxing, stress-free move. Make sure you create lists, or spreadsheets, or colour-coded labels. Whatever your system, organisation is key.

Consider also a few key elements –

Packing tips

Here’s how you can try and pack as efficiently as possible:

Moving Checklist – General things to consider when moving

Six weeks before

Two weeks before

Night before

Want to stay in the loop?

Subscribe to our free newsletter